3 min read

Written by

Colossus Digital

Published on

Jan 16, 2026

Enabling secure, institutional-grade delegation across leading custody providers

Colossus is pleased to announce the integration of multiple Cosmos’ assets into the Institutional Hub, enabling financial institutions to delegate them directly from their existing custody infrastructure. With this addition, banks, asset managers, foundations, and exchanges can now stake Injective without moving assets out of their secure, compliant environments—including through Fireblocks, Ledger Enterprise, Dfns, and additional supported providers.

This integration marks a significant step toward unlocking safe, transparent access to on‑chain yield for institutions operating at scale.

Understanding the cosmos ecosystem: A foundation for institutional-grade interoperability

In addition to Atom, Celestia, Secret, and other assets already integrated within the Institutional Hub, several new high‑value networks have now been added, including Lava, Injective, Osmosis, Agoric, Axelar, and others.

Here is the list of all assets supported within the Institutional Hub.

These recently added assets are core components of the Cosmos ecosystem, an expanding network of sovereign blockchains built on the Inter‑Blockchain Communication (IBC) protocol. Cosmos was designed to address one of the most fundamental challenges in blockchain infrastructure: interoperability. Its modular architecture enables chains such as Injective, Axelar, Lava etc. to deliver high performance and sovereignty while remaining seamlessly connected to a broader ecosystem of applications, liquidity layers, and financial primitives.

For institutional players, Cosmos offers key advantages:

Robust security frameworks supported by staking and validator-set decentralization

Interoperability via IBC, enabling cross-chain expansion while retaining risk controls

High throughput and low transaction costs, suitable for enterprise and exchange-grade applications

A rapidly growing network of institutional‑relevant chains, including app‑specific layer‑1s and financial infrastructure protocols

Collectively, these assets are purpose‑built for performance, offering fast, interoperable, and decentralized environments where institutional‑grade applications can be deployed and scaled efficiently.

New integrations for Staking at institutional standards

With these assets now live on the Institutional Hub, institutions can stake INJ, LAVA, AXL etc. with unprecedented security and operational efficiency, unlocking assets in custody.

The integration provides:

Direct delegation from custody providers

Institutions can delegate while assets remain securely held within their existing custody setup across Fireblocks, Ledger Enterprise, Dfns, and other integrated custodial solutions. No asset movement, no operational overhead, and no new workflows are required. All existing transaction‑policy configurations are fully preserved and respected.

Validator choice and strategy flexibility

Institutions can select from multiple validators, allowing them to align staking activities with internal governance, risk, or ESG frameworks.

Enhanced transaction assurance

Every transaction related to staking benefits from multiple layers of protection: transaction Lens for detailed visibility, decoder verification to ensure transaction integrity, multi‑party transaction crafting to enforce internal authorization policies, pre‑execution simulation to preview and validate expected outcomes. This ensures every delegation and undelegation follows compliant, institution‑ready pathways.

Integrated Portfolio management

The Institutional Hub provides a consolidated view across: Custodied tokens, Staked balances, Pending withdrawals, Unbonding positions. Institutional teams can monitor, audit, and report on their Cosmos assets staking activity with clarity and precision.

Why this matters for institutional portfolios

As the digital asset market matures, institutions increasingly require secure and compliant access to on‑chain yield without compromising their custody standards.

Cosmos assets' integration into the Institutional Hub delivers:

Scalable exposure to a leading interoperable layer‑1 without operational complexity

Yield generation through staking, directly aligned with institutional security mandates

Risk‑controlled participation in the Cosmos ecosystem

Streamlined treasury management, reducing manual operations and eliminating unnecessary asset transfers

This is precisely the type of infrastructure institutions need to participate meaningfully in blockchain networks while maintaining rigorous internal controls.

Watch how it works

To see the integration in action, watch the video below.

Conclusion

The addition other Cosmos assets to the Colossus Institutional Hub is another milestone in our mission to provide secure, scalable, and enterprise‑grade access to on‑chain yield. By enabling direct delegation from leading custody solutions, Colossus ensures that institutions can engage with high‑performance blockchain networks while upholding the highest standards of risk management and governance. We look forward to continuing to expand institutional access to top-tier networks across the blockchain ecosystem.

Staking

3 min read

Feb 13, 2026

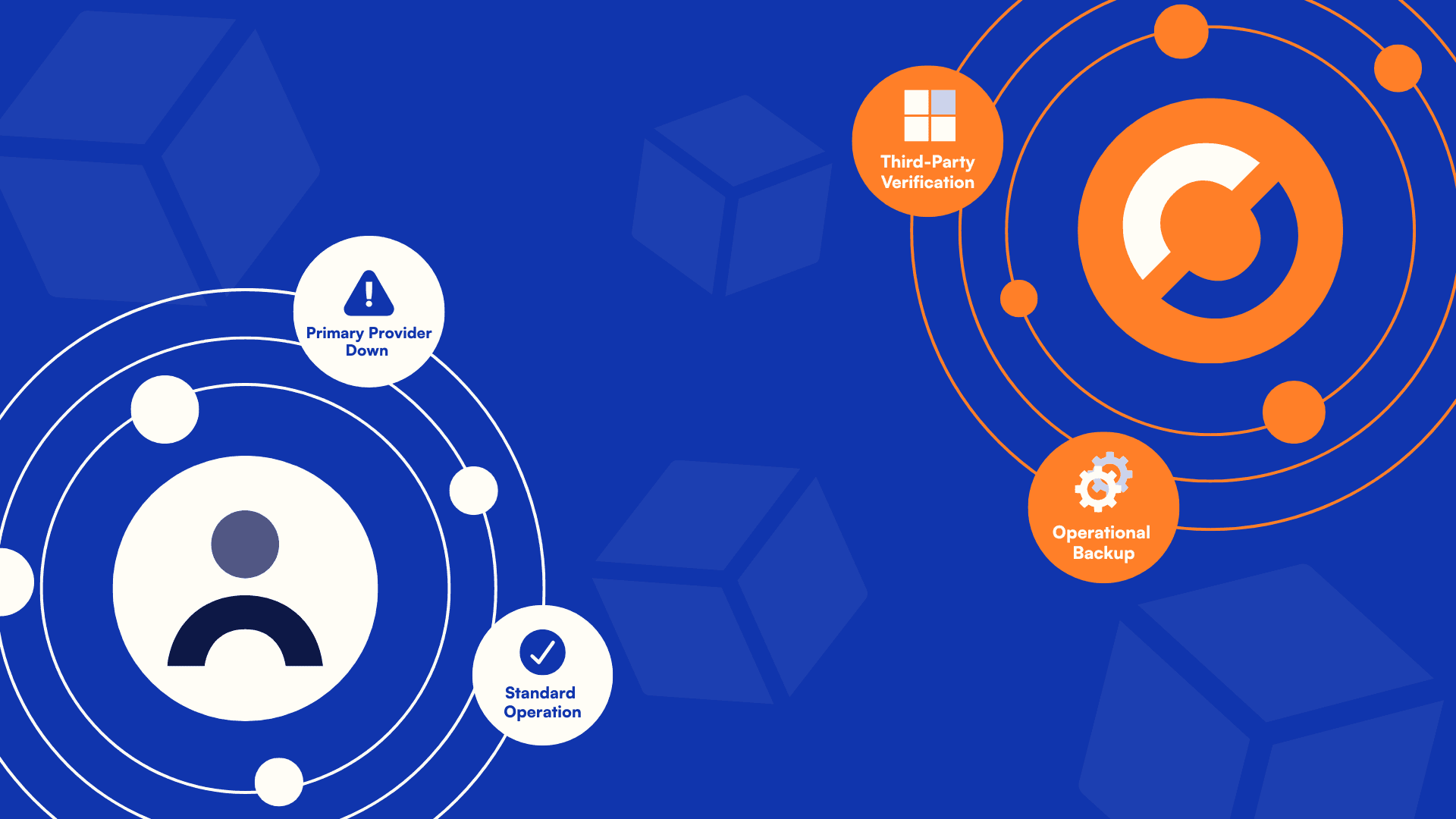

Operational Continuity for Institutional Staking

Institutional staking has matured rapidly over the last years, becoming a foundational component of digital asset strategies...

Institutional Hub

3 min read

Jan 16, 2026

New Cosmos assets are now available on Institutional Hub

Bringing institutional‑grade security and interoperability to Cosmos staking via the Institutional Hub. Stake from your custody to a validator of choice...

Tech

4:30 min read

Oct 3, 2025

ETH upgrade, Fusaka: What is it? What does it mean for institutional asset holders?

Ethereum’s Fusaka upgrade is not just another protocol update, it’s a foundational shift in how Ethereum handles validator operations...