5 min read

Written by

Colossus Digital

Published on

Sep 23, 2025

Introduction

The Colossus Digital Institutional Hub is a B2B platform that enables financial institutions to stake more than 20 different assets to a validator of choice, directly from their existing custody solutions (e.g., Fireblocks, Ledger Enterprise, Dfns etc), without moving assets to external wallets. The signing process remains entirely in custody.

The Hub normalizes multi-chain workflows, validator selection, delegation, and reward management, while inheriting your policy engine (multi-sig, whitelists, approvals) and producing tamper-evident audit trails. With role-based access, tenant isolation, and real-time performance analytics, the Hub transforms staking into a first-class, compliant, and scalable operation for banks, asset managers, funds, foundations, exchanges, and other financial institutions. It allows them to generate yield that would otherwise remain locked in custody.

How it works: Bridging custody and staking

Think of the Hub as a secure bridge between your custodian and the validator you select.

1. Set up your tenant

Each client sets up its company tenant, defining roles, restrictions, and security parameters.

2. Connect custody

Integrate your custody provider(s). Assets remain within the custodian’s controlled environment (e.g., Fireblocks, Ledger Enterprise, Dfns).

3. Select network & validator

Choose the PoS network and the operation (stake, restake, unstake, etc.), select your preferred validator, set the amount, upload the key file, and submit the request. The Hub abstracts chain-specific complexity and normalizes workflows.

4. Sign in custody

Transactions are crafted and signed directly inside your custody provider, preserving MPC/HSM protections and internal controls.

5. Monitor & report

A real-time portfolio view provides validator performance, APR, assets under custody (AuC), assets under staking (AuS), locked assets, rewards generated, and more.

What’s new in the latest version

Tenant-first architecture: Each workspace can be fully customized with role-based access and policies.

Single-select assets flow: A streamlined dropdown resolves provider and group context for faster operations.

Network Info & Status panel: Each asset page displays network parameters (activation, lock, unbonding periods, minimum stake) and live wallet status.

Cleaner, faster UI & UX: Fewer clicks, consistent patterns, institutional-grade readability.

Portfolio overview: A single interface to view all staked, unstaked, available, and locked assets.

Why choose the Institutional Hub

Security by design: All transactions remain within the custodian; no assets leave custody.

Policy continuity: Whitelists, approvals, velocity limits, and key ceremonies are enforced, with additional policies configurable in-platform.

Operational simplicity: One interface for multi-chain staking, validator selection, re-staking, and reward withdrawals.

Compliance & auditability: End-to-end logs, exportable evidence, and full governance transparency.

Performance visibility: Live APR, uptime metrics, and chain-specific nuances surfaced before signing.

Who it’s for

The hub is thought to connect two different targets, on one side all the financial institutions and on the other side yield providers.

Banks & financial institutions: Custody-native, policy-controlled staking.

Asset managers and funds: Compliant yield on held assets.

Foundations & treasuries: Governance participation with strict key management.

Exchanges: Activate staking flows without fragmenting infrastructure.

Family offices, VCs, and other institutional clients.

Validators: Onboard institutional capital with standardized workflows.

Business impact & added value

Unlock idle balances: Convert PoS assets into on-custody yield.

Reduce operational risk: Eliminate off-platform wallets and manual workflows.

Lower total cost of ownership: One integration covers multiple chains; fewer bespoke builds.

Conclusion

The updated Colossus Digital Institutional Hub bridges the long-standing gap between secure custody and on-chain participation. By making staking a fully integrated custody workflow, the Hub provides institutions with yield, governance, and control—all while maintaining the highest standards of security and compliance.

Staking

3 min read

Feb 13, 2026

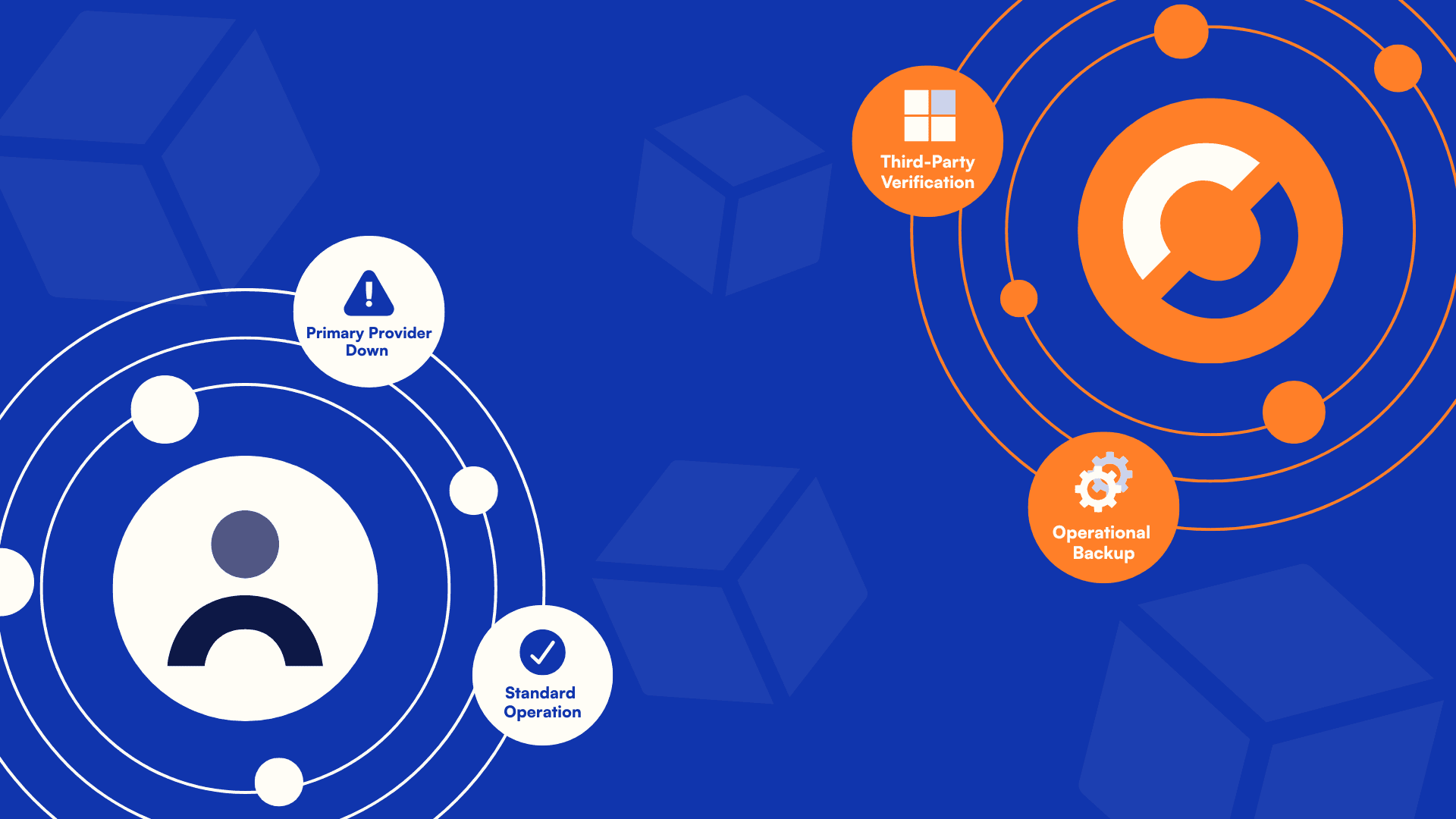

Operational Continuity for Institutional Staking

Institutional staking has matured rapidly over the last years, becoming a foundational component of digital asset strategies...

Institutional Hub

3 min read

Jan 16, 2026

New Cosmos assets are now available on Institutional Hub

Bringing institutional‑grade security and interoperability to Cosmos staking via the Institutional Hub. Stake from your custody to a validator of choice...

Tech

4:30 min read

Oct 3, 2025

ETH upgrade, Fusaka: What is it? What does it mean for institutional asset holders?

Ethereum’s Fusaka upgrade is not just another protocol update, it’s a foundational shift in how Ethereum handles validator operations...